IFFCO TOKIO CUSTOMER APP

IFFCO TOKIO CUSTOMER APP

Customer App from IFFCO Tokio General Insurance is a one-stop solution for all your insurance needs. The app keeps you ahead in this busy world by catering to all your requirements from buying and renewing the policy to the speedy settlement of claims from the comforts of your home. The customer-friendly app helps you to manage all your policies on the go. The process to register is also very simple. All you need is to share your email id and a mobile number to get started.

Here is a lowdown on what all services the app offers:

1. Buy policy

The app offers policyholders an option to buy different types of policies ranging from motor, health, travel, home to trade insurance.

2. Policy renewal

The app also gives policyholders an option to renew the policy online. It sends policyholders automatic alerts when the renewal date approaches.

3. Policy copy download

You can manage your policies in one place with the help of the app. Apart from checking policy details, you can also download a copy of your motor and health policies through the app.

4. Health Ecard download

There are times when you forget to carry your health cards. With the app on your mobile, you do not even need to worry as it gives you an option to download the health e-card for a seamless claim experience.

5. Search Facilities

The app offers the facility to locate network hospitals and garages for availing cashless services. The app will also assist you in directions to the nearest location of your choice.

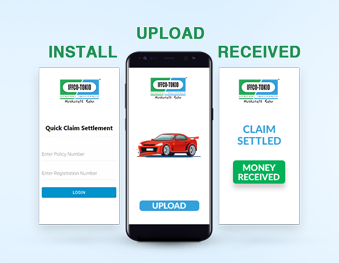

6. QCS -Quick Claim Settlement

Motor QCS: Unlike the Traditional Claims Process where the settlement of claim takes a longer time, under the QCS process the claim gets settled the very moment your vehicle reaches the workshop. The entire experience is seamless with our easy to use and extremely user-friendly Mobile App. “QCS”.

Here are some of the key features of Motor QCS:

1. Under QCS, claims can be made for private cars or two-wheelers.

2. For claims to be made under QCS, the claim amount can be up to the limit of Rs 50,000 for private car policies and Rs 50,000 for two-wheeler policies.

3. QCS officer will ensure that your vehicle gets moved to a workshop for necessary repairs and the customer need not visit the workshop on their own.

4. QCS claims are settled within the same day, once your vehicle approaches a workshop and the repair work begins.

5. QCS claim settlement process gives our customers the freedom of getting their claim registered from within the comforts of their home/office.

HEALTH QCS

With our QCS application already in place for Motor claims, we have come up with a technical advancement in health claims settlement through QCS (Quick Claim Settlement).

QCS refers to the Quick settlement of the claims on reimbursement basis where the claimed amount for an incidence is less than Rs. 25,000. This settlement is full and final and is done on an instant basis.

The entire experience is seamless with our easy to use and extremely user-friendly mobile app.

Here are some of the key features of Health QCS:

1. Instant reimbursement of your expenses on an indemnity.

2. The claim intimation and document submission up to Rs 25,000 may be submitted to us through the app.

3. Instant status update in the mobile app.

4. Fast payment after claim approval.

Claim Procedure

The customer will have the option of calling the Customer Care Centre (Toll-Free) on 18001035499 for registering the claim or downloading the mobile application directly from our website and register the claim. Upon successful registration of the claim, our QCS officer will get in touch with the customer and help them by providing further instructions.

FAQ’s

MOTOR QCS FAQ’s

What is Motor QCS?

QCS stands for Quick Claim Settlement. Under the QCS process, the claim gets settled the very moment your vehicle reaches the workshop.

How can I intimate claim under QCS?

A claim can be registered by downloading the mobile application directly from the above link.

What kind of claims come under QCS category?

Private car & Two-wheeler claims where a policy is purchased through a branch or by online medium comes under the QCS category.

What are the working hours for QCS claim settlement?

The QCS claims process is available on all working days except Saturday, Sundays and public holidays. The working hours for the QCS claim settlement is from 9:00 AM to 5:30 PM on all working days.

Is there any financial limit for assessment under the QCS claim?

QCS claims are subject to following financial limits of assessment: Two Wheeler: Rs. 50,000 and for Personal Car: Rs. 50,000.

Do I need to take my vehicle to workshop for claiming under QCS?

QCS claim officer shall ensure to get your vehicle moved to a workshop for necessary repairs and customers need not visit the workshop on their own.

How much time will it take to settle my QCS claim?

QCS claims are settled within the same day, once your vehicle approaches a workshop and the repair work is started.

What if I am not satisfied with the QCS claim settlement amount?

The customer has complete freedom to disagree with the QCS settlement amount and take the vehicle to any workshop of his/her own choice and get the vehicle inspected through the standard claim process.

What if the workshop charges extra amount from me other than QCS claim amount?

QCS process ensures to obtain prior quotations from the workshop for the work to be undertaken on the vehicle. Workshop has to honor the quotation while undertaking repairs. In event of any extra repair work (not included in the original assessment), the same shall be re-assessed and settled by the QCS officer after verifying complete details.

What will be the total settlement time for the claim?

A claim under the QCS process gets settled within the same day of vehicle reaching the workshop for necessary repairs.

Why is it better than older claim settlement procedures?

QCS claim settlement process gives the insured freedom of getting the claim registered within the comforts of your home/office. The claim amount is paid upfront without waiting for the vehicle to get repaired and all the hassles of taking the vehicle to the workshop and needless discussions on the repair required are eliminated. All in all an hassle-free, fast & convenient claims service is ensured through the QCS process.

How to upload bank details in QCS application?

The mobile application of QCS is very user-friendly and the insured can update the bank details within the mobile application to get the claim amount directly transferred to his/her bank account.

Can it be done using desktop/laptops?

No, currently the service can only be used through the QCS Mobile application by directly downloading the app on a mobile phone.

Can it be done on smart phones using IOS? If yes how?

Yes, QCS mobile application is available on IOS. The process remains the same as with the Android device. A user just needs to download the QCS mobile application and start using the same.

What is the process to cancel a QCS claim, what if I do not want to lose on my NCB and cancel the claim?

In case the insured doesn’t want to pursue the claim and wish to withdraw, he/she can inform the QCS officer about the same and the claim shall be treated as withdrawn. In such cases insured will not lose the NCB on renewal.

My vehicle is currently lying at a work-shop, can I move it to my home to make may case eligible for QCS?

The vehicle is required to be out of the workshop to report a QCS claim. In case the insured wishes to opt for a workshop of his/her own choice, the same can be arranged by the QCS team provided the chosen workshop agrees to the terms shared by the QCS claim team.

FAQ’s

HEALTH QCS FAQs

What is Health QCS?

QCS or Quick claims settlement refers to the settlement of the claims on an instant basis where the claimed amount for an incidence is less than Rs 25,000. This settlement is full and final and does not allow pre-post or supplementary benefits/ extensions.

What is the procedure for QCS?

QCS is handled on a reimbursement basis- If the patient is already discharged and the total expenses incurred are less than Rs 25,000, then there is no need to submit the physical documents to us. Only uploading the clear photographs of all the documents mentioning “CLAIMED FROM IFFCO TOKIO GENERAL INSURANCE COMPANY LIMITED- QCS REIMBURSEMENT FACILITY”, and providing us certain details shall serve the purpose of the claim settlement.

What are the working hours for QCS claim settlement?

The QCS claims process is available on all working days except Saturday, Sundays and public holidays. The working hours for the QCS claim settlement is from 9:00 AM to 5:30 PM on all working days.

Is there any financial limit for assessment under the QCS claim?

QCS claims are subject to following financial limits of assessment: Rs. 25,000 per incidence

What are the documents which may be required for QCS claims?

The QCS claims would require the following documents to be uploaded through the app by the insured

For Reimbursement-The documents that will be considered for assessment should be a clear photo of the original documents with a handwritten self-statement on all the original documents mentioning- ”Claimed with IFFCO Tokio General Insurance Co for QCS”

- Original discharge summary

- Original final bill

- Original receipt

- Original prescriptions/ consultation papers/ other bills/ reports etc.

- Duly filled signed & stamped claim form

- Valid copy of hospital registration certificate or hospital infrastructure details

- Cancelled cheque of the insured containing the name of the account holder with IFSC Code printed over it.

- Valid photo ID of the patient

- Picture of the affected area if any

- MLC/ FIR copy in accidental cases with a certificate from the treating doctor if the patient is under influence of alcohol

- Other documents which the assessing officer may require for your claim adjudication

What is the claim procedure?

We provide you the option of calling the Customer Care Centre (Toll-Free) on 18001035499 for registering the claim or downloading the mobile application directly from our website and register the claim. Upon successful registration of the claim, you shall be requested to upload all the required claim-related documents. If required, our QCS officer will get in touch with the customer and help them by providing further instructions.

If my claim is rejected in QCS, can I send my documents for reimbursement.

Yes, you have all the rights to claim your hospitalization expenses in a normal reimbursement flow by submitting all your original documents to us.

In how many days shall I get the payment?

If you have your IMPS enabled account, and on submission of the complete documents, and information with complete clarity, most of the cases shall be settled within 7 working days. In case, your account is not IMPS enabled, we will route your case as a normal case and request you to submit your original documents.

I am unable to submit my claim as the hospital is not found in your system.

In case your preferred hospital is not found, you may please contact our call center who shall help you in the registration of your claim.